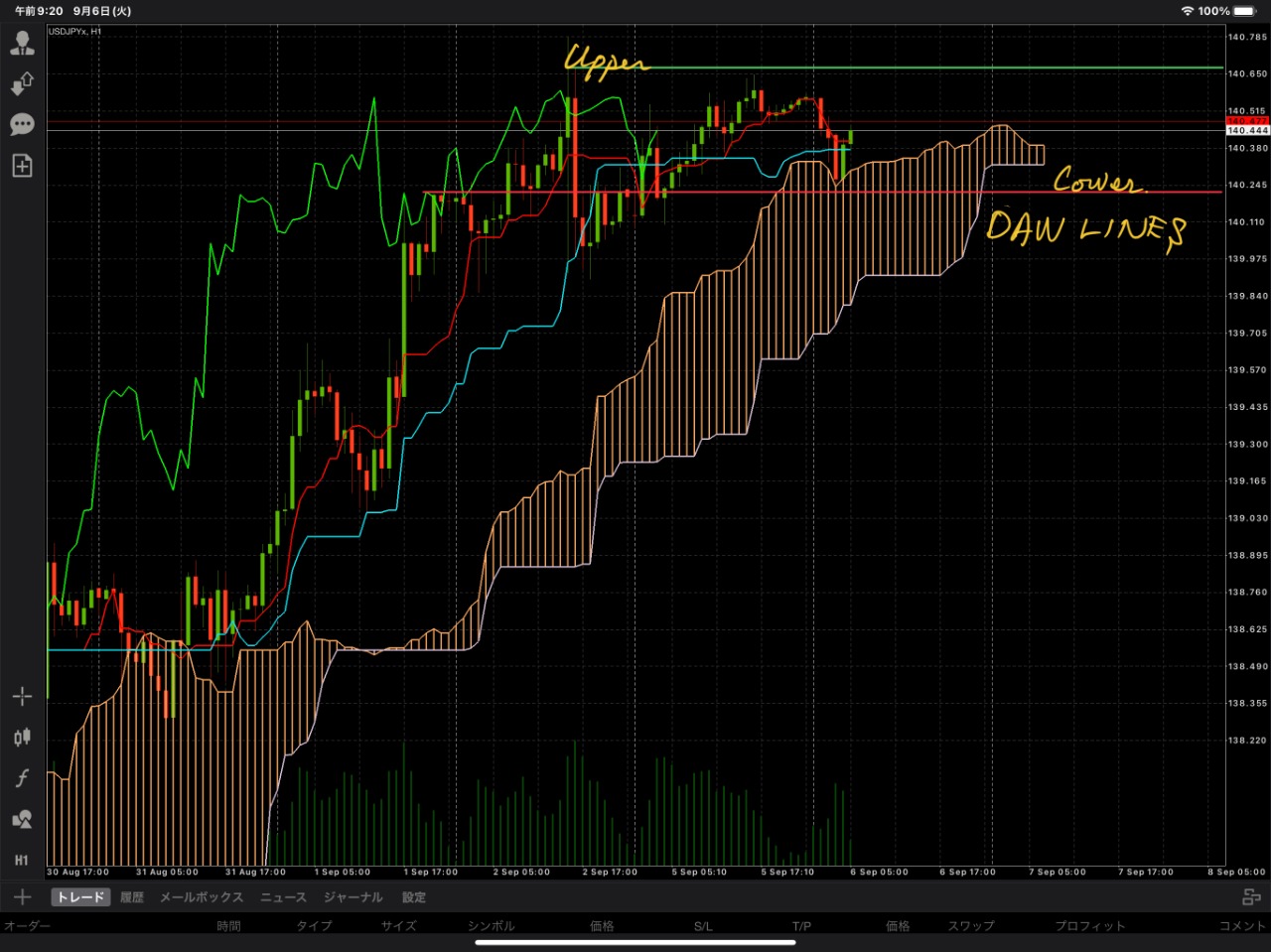

USD/JPY Technical Analysis

- 2022-09-06

After bottoming out at 130.40, the most recent low recorded on August 2, the dollar/yen reversed, and on Friday (September 2), it surged to 140.80, the highest level in about 24 years since August 31, 1998. (10.4-yen surge in just one month). During this period, all major resistance points were broken out on the daily, weekly, and monthly candle, and multiple strong buy signals (Ichimoku Kinko Hyo three-way turnaround, bullish perfect order, Dow theory uptrend) continued to light up. From a technical point of view, the sentiment can be judged to be “extremely strong.”

In terms of fundamentals,

1. the US Fed is expected to be more hawkish (75bp rate hike expected at the FOMC in September + continuation of rate hikes expected at the FOMC in November and December + receding rate cut next year).

2. monetary easing by the Bank of Japan (At the Jackson Hole meeting, Governor Kuroda reiterated his policy of continuing monetary easing).

3. U.S. government and U.S. authorities’ stance of accepting a strong dollar (the U.S. tacitly tolerates a strong U.S. dollar, which could lead to the suppression of inflation; it is difficult for Japanese authorities to intervene in yen buying).

Today we will be paying attention to the August US Composite PMI final figures, which will be released at 20:45 Cambodian time and the US August ISM Non-Manufacturing Composite Index, which will be released at 21:00 Cambodian time. will gather. If US economic indicators exceed market expectations, a scenario in which the US dollar/yen pair breaks through the psychological milestone of 141.00 in the path of rising US long-term interest rates → US dollar buying is also assumed. As risk reversal yen putovers are expected to rise further in the options market, we should be particularly cautious of the upside risk of the dollar/yen during today’s overseas time.

Today’s expected range: 139.75-141.25.

Analyst: Mr. Naoto Arase, Independent Analyst