DAILY MARKET OVERVIEW-15.04.2024

- 2024-04-15

JPMorgan Chase CEO Jamie Dimon warned Friday that multiple challenges, primarily inflation and war, threaten an otherwise positive economic backdrop.

“Many economic indicators continue to be favorable,” the head of the largest U.S. bank by assets said in announcing first-quarter earnings results. “However, looking ahead, we remain alert to a number of significant uncertain forces.”

An “unsettling” global landscape, including “terrible wars and violence,” is one such factor introducing uncertainty into both JPMorgan’s business and the broader economy, Dimon said.

Additionally, he noted “persistent inflationary pressures, which may likely continue.”

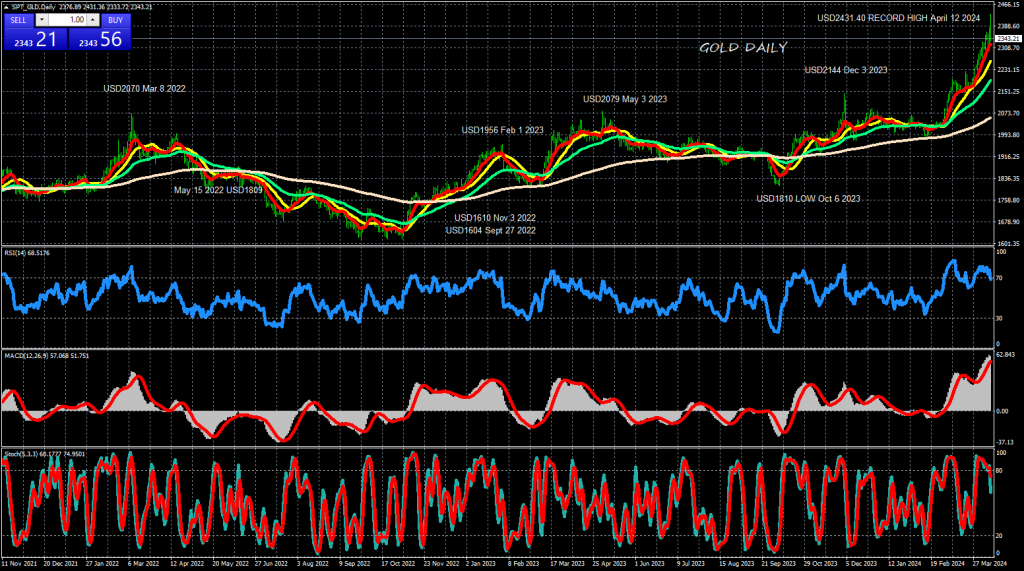

- Gold hit yet another historic peak following a short-lasting correction.

- XAU/USD ignores rising US yields and broad USD strength.

- The technical outlook shows that Gold remains extremely overbought.

Gold price (XAU/USD) looked like it was on the verge of a deep correction on Wednesday but it gathered bullish momentum in the second half of the week, advancing to a fresh all-time high above $2,400. In the absence of high-tier data releases from the US, growth data from China and geopolitical developments could impact Gold’s valuation next week.

Gold rally continued despite surging US yields this week

Gold started the new week on a bullish note and closed the first two trading days of the week in positive territory. As the trading action remained relatively subdued ahead of the key inflation data from the US, however, XAU/USD’s gains remained limited.

The US Bureau of Labor Statistics (BLS) reported on Wednesday that annual inflation, as measured by the change in the Consumer Price Index (CPI), rose to 3.5% in March from 3.2% in February. This reading came in above the market expectation of 3.4%. Details of the report showed that the CPI and the core CPI, which excludes volatile food and energy prices, both increased 0.4% on a monthly basis. The benchmark 10-year US Treasury bond yield surged to its highest level since mid-November above 4.5% and the USD Index climbed to five-month tops above 105.00 after inflation readings, triggering a downward correction in Gold.

The probability of the Federal Reserve (Fed) leaving the policy rate unchanged in June jumped to nearly 80% from 40% before the CPI data release, according to the CME FedWatch Tool. In turn, XAU/USD fell nearly 1% and registered daily losses on Wednesday, just for the second day in the last two weeks.

Although the USD preserved its strength on Thursday, escalating geopolitical tensions allowed Gold to regather bullish momentum. Iran has promised to retaliate, blaming Israel for the attack on its consulate in Syria earlier in the month and reviving fears over a deepening conflict in the Middle East.

The European Central Bank (ECB) maintained its key rates after the April policy meeting on Thursday. Citing three sources, Reuters reported that on Thursday that ECB policymakers were on track to lower the policy rate in June. The sharp upsurge seen in the XAU/EUR pair showed that Gold captured capital outflows out of the Euro. The pair trades at a record high above €2,200 and it’s up about 9% in April after gaining nearly 10% in March.

As markets sought refuge ahead of the weekend, Gold continued to push higher and rose above $2,400. In addition to risk-aversion, central bank buying is thought to be another driver behind Gold’s unprecedented rally. “The fundamentals underpinning the current rally include growing geopolitical risk, steady central bank buying and resilient demand for jewelry and bars and coins,” World Gold Council said in its monthly report published earlier this week.

Gold investors stay focused on geopolitics

Retail Sales for March will be the only noteworthy data featured in the US economic calendar next week. On a monthly basis, Retail Sales are forecast to rise 0.3% following the 0.6% increase recorded in February. In case there is a negative print, the immediate reaction could cause the USD to weaken slightly.

In the Asian session on Tuesday, Gross Domestic Product (GDP) data for the first quarter from China will be watched closely by market participants. The Chinese economy is forecast to grow at an annual rate of 5%, down from the 5.2% expansion registered in the fourth quarter of 2023. A disappointing GDP print from China, the world’s biggest consumer of Gold, could cause concerns over the yellow metal’s demand outlook and limit XAU/USD’s upside in the short term.

Meanwhile, investors will remain focused on geopolitical developments. A de-escalation of the conflict in the Middle East could trigger a deep correction in Gold. On the other hand, XAU/USD is likely to continue to find support in a risk-averse market environment, even if the USD continues to outperform its rivals on growing expectations for a delay in the Fed policy pivot.

GBPUSD

Cable fell to the lowest in nearly five months on Friday, following fresh bearish acceleration through psychological 1.2500 support and Fibo level at 1.2465 (50% retracement of 1.2037/1.2893 uptrend.

Breach of a multi-month range floor (1.2518) weakens the structure and increases risk of deeper fall on completion of a double-top pattern on weekly chart.

Bearish daily studies (14-d momentum remains in negative territory / MA’s in bearish setup and formation of 5/200DMA death cross) contribute to negative outlook.

Weekly close below 1.2500 zone is minimum requirement to keep fresh bears in play and to confirm bearish signal for extension towards next target at 1.2364 (Fibo 61.8%).

Corrective upticks should be capped under broken Fibo 38.2% level (1.2566) to offer better selling opportunities.

Caution on firm break above 200DMA (1.2583).

Prepared by: Mr.SAM KIMA, Senior Vice President