DAILY MARKET OVERVIEW-22.04.2024

- 2024-04-22

- Dollar goes on a rampage as traders unwind Fed rate cut bets

- Risk aversion in stock markets amid Iran tensions helps too

- Upcoming US releases will decide whether rally can go further

Dollar shines bright

It’s been a phenomenal year for the US dollar so far. The greenback has gained more than 4% against a basket of currencies, turbocharged by a series of solid economic readings that have forced investors to dial back bets of imminent Fed rate cuts.

Heavy government spending and a surge in population growth driven by an influx of immigration have helped shield the US economy, bolstering the labor market and consumer demand.

Reflecting this resilience, inflationary pressures have been persistently hot. In fact, some measures of underlying inflation have re-accelerated in recent months, making it extremely difficult for the Fed to cut interest rates.

Summary

United States: Another Week, Another Strong Showing from the U.S. Consumer

- Robust retail sales data were the main story on the U.S. economic data front this week. Elsewhere, data for industrial production and jobless claims offered additional evidence that the U.S. economy remains on solid footing.

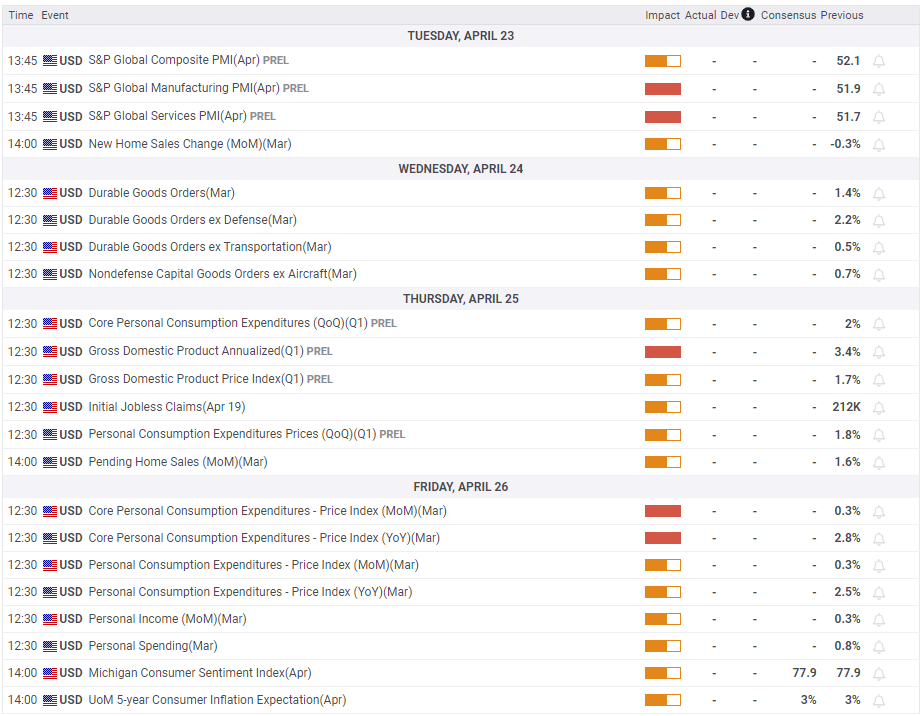

- Next week: New Home Sales (Tue.), GDP (Thu.), Personal Income & Spending (Fri.)

International: Israel-Iran Tensions Come to the Surface

- Recent tension between Israel and Iran shows that finding a steady state in the Israel-Hamas war remains elusive. We continue to believe military conflict will remain contained and not expand into Tehran or the broader Middle East. In England, inflation continues to ease, but perhaps not as quickly as policymakers may have hoped for.

- Next week: Middle East Geopolitical Tensions, India Prime Minister Election (Apr.-Jun.), Central Bank of Turkey (Thu.)

Interest Rate Watch: Will Home Buyers Ever Get Some Relief from Elevated Mortgage Rates?

- The 30-year fixed rate mortgage has risen recently, but it still remains below last autumn’s high-water mark of 8%.

Topic of the Week: Steel Your Nerves, Biden Proposes Higher Tariffs on Chinese Imports

- This week, President Biden announced a plan to more than triple tariffs on Chinese aluminum and steel products. As stated in our recent special report, tariffs are often imposed to promote demand for local products and spur domestic production, but the effects of tariffs on Chinese-imported goods have been marginal for U.S. industrial production over the past six years. Will the same hold true with Biden’s proposed policy?

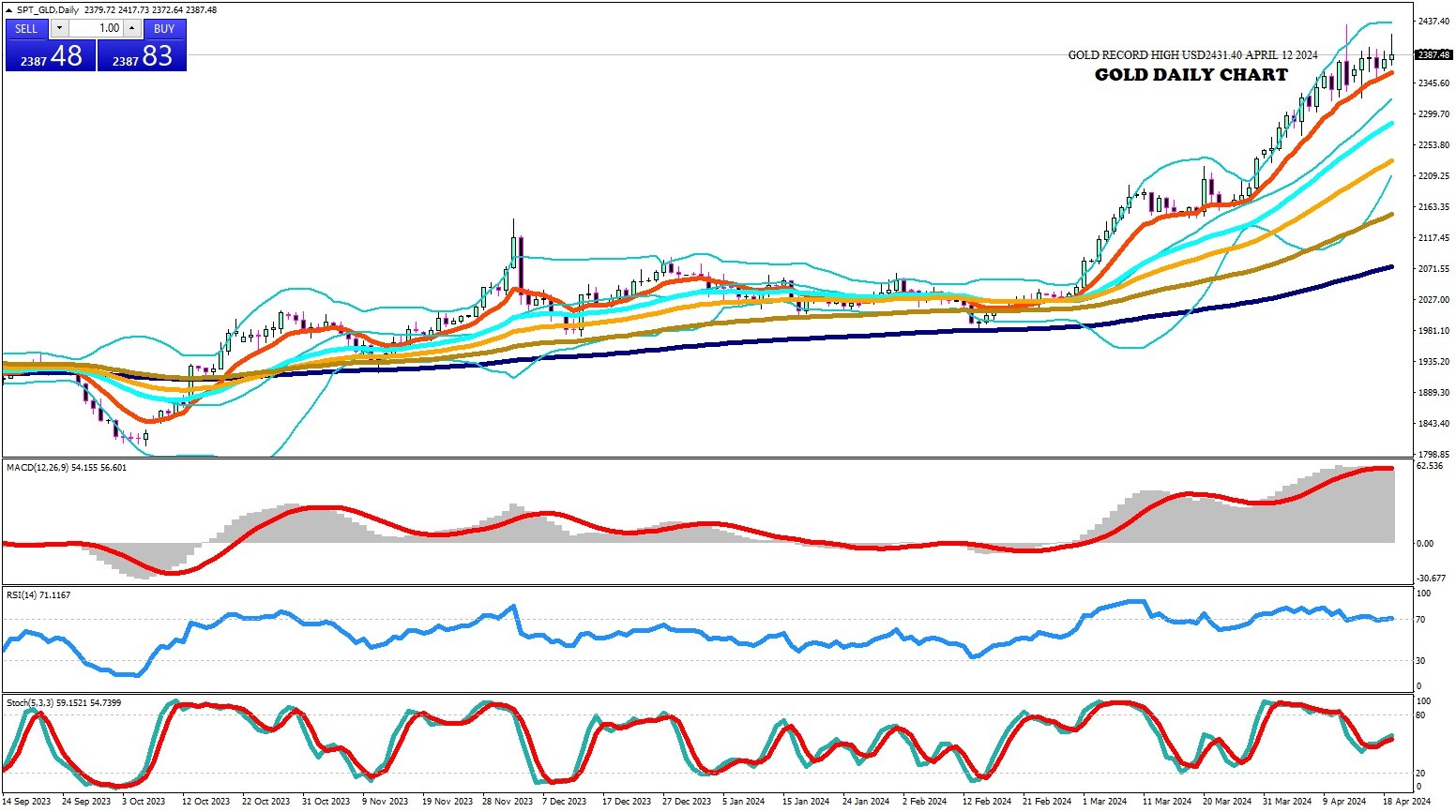

Gold investors await key US data

Market participants will stay focused on geopolitics next week. A de-escalation of the Iran-Israel crisis could trigger a downward correction in XAU/USD and cause the market focus to shift to the US data. On the other hand, another retaliatory response by Iran could revive fears over a deepening crisis in the Middle East and allow Gold to continue to capitalize on safe-haven demand.

On Thursday, the US Bureau of Economic Analysis (BEA) will release the Advanced Gross Domestic Product (GDP) data for the first quarter. In case the US economy posts a stronger-than-forecast annualized growth, the USD could hold its ground and weigh on XAU/USD. Since the beginning of April, Gold has been ignoring rising US yields and the broad USD strength. If geopolitics finally move to the back burner, Gold could come under bearish pressure, with investors adjusting their positions to growing expectations for a Fed policy hold in June. According to the CME FedWatch Tool, there is a less than 20% chance the Fed will lower the policy rate by 25 basis points in June.

On Friday, the BEA will publish the Personal Consumption Expenditures (PCE) Price Index data, the Fed’s preferred gauge of inflation, for March. Thursday’s GDP report will include the PCE Price Index data for the first quarter. Hence, Friday’s PCE reading will not offer any surprises and is unlikely to trigger a market reaction. Moreover, Fed Chairman Powell said that the annual core PCE inflation was little changed in March, according to their estimates.

Prepared by: Mr. SAM KIMA, Senior Vice President