DAILY MARKET OVERVIEW-26.04.2024

- 2024-04-26

-

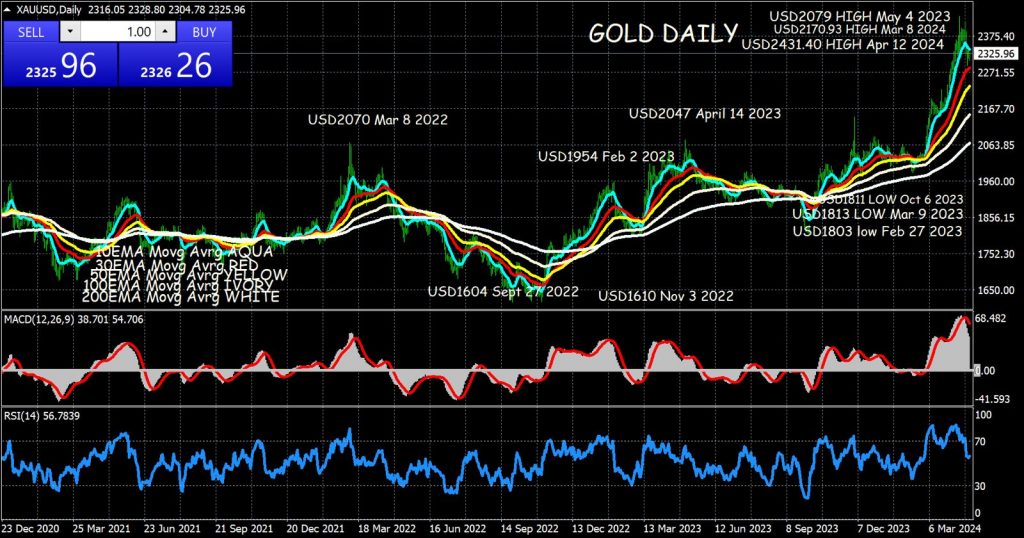

- Gold price holds intraday gains above $2,300 amid higher US Q1 GDP Price Index.

- The Fed will maintain the “higher for longer” interest rates argument.

- The easing of tensions in the Middle East has improved the demand for risky assets.

Gold price (XAU/USD) sustains above the crucial support of $2,300 in Thursday’s early New York session. The US Dollar and bond yields strengthened after a significant rise in the Q1 Gross Domestic Product (GDP) Price Index to 3.1% from the former reading of 1.7%. This has deepened the risks of the Federal Reserve (Fed) delaying rate cuts later this year. The US Dollar Index (DXY), which tracks the US Dollar’s value against six major currencies, recaptures 106.00. 10-year US Treasury Yields jump to 4.70%. Historically, higher yields on interest-bearing assets increase the opportunity cost of holding investment in Gold.

While a stubbornly higher price index has deepened fears of interest rates remaining higher, a sharp decline in GDP growth has raised concerns over the US economic outlook. The US economy expanded at a significantly slower pace of 1.6% from expectations of 2.5%. In the last quarter of 2023, the economy grew strongly by 3.4%.

Going forward, investors will focus on the core Personal Consumption Expenditure Price Index (PCE) data for March, which will guide the next move in the Gold price.

Daily digest market movers: Gold price holds steady while US Yields rise

- Gold price maintains auction above $2,300. The US Dollar rises amid hopes that the Fed will maintain its current interest rate framework for a longer period.

- The week is full of volatile events as the core PCE inflation data will follow the Q1 GDP data – the Fed’s preferred inflation measure – for March, which will be published on Friday. Core PCE inflation is expected to have grown steadily by 0.3% on a month-on-month basis, with annual figures softening to 2.6% from the 2.8% recorded in February.

At the same time, a new batch of very positive weekly unemployment data was released. Initial jobless claims fell to 207K, the lowest since February. The number of repeat claims fell to 1781K – the lowest in three months. It is worth noting that these are very low figures by historical standards. The tense situation in the labour market will create domestic inflationary pressures even if commodity prices start to decline.Meanwhile, there was bad news on the inflation front, as the personal expenditures price index (PCE), which is considered the Fed’s preferred inflation gauge, jumped 3.4% y/y in the first quarter, up sharply from 1.8% in the fourth quarter and its largest gain in a year. Core PCE, which excludes food and energy, rose 3.7%, above the market estimate of 3% and crushing the fourth quarter gain of 2%.Today’s report is a discouraging sign for the Fed, as growth was lower than anticipated and inflation was higher than expected. The rise in inflation shouldn’t come as a major surprise though, as consumer inflation has risen in the past two releases.The markets reacted negatively to the news, with investors now pricing in just one rate cut in 2024. A rate hike, which would have been unthinkable at the start of the year, is a real possibility if the economy remains in good shape and inflation continues to rise – the options markets have priced in a 20% probability of a rate hike within the next 12 months.EUR/USD has struggled to maintain its position above the 1.0723 level, which acted as support turned resistance. The pair briefly breached this threshold but failed to sustain momentum. The immediate focus is now shifting to the 1.0677 minor support. EUR/USD may resume its downward trajectory from the 1.0980 high, potentially revisiting lows around 1.0601. I’m bullish on EURO; GBP; AUD. And bearish on GOLD; JPY for next week leading into month of May.

Prepared by: Mr. SAM KIMA, Senior Vice President