Sterling slides with diminishing forecast

- 2020-06-12

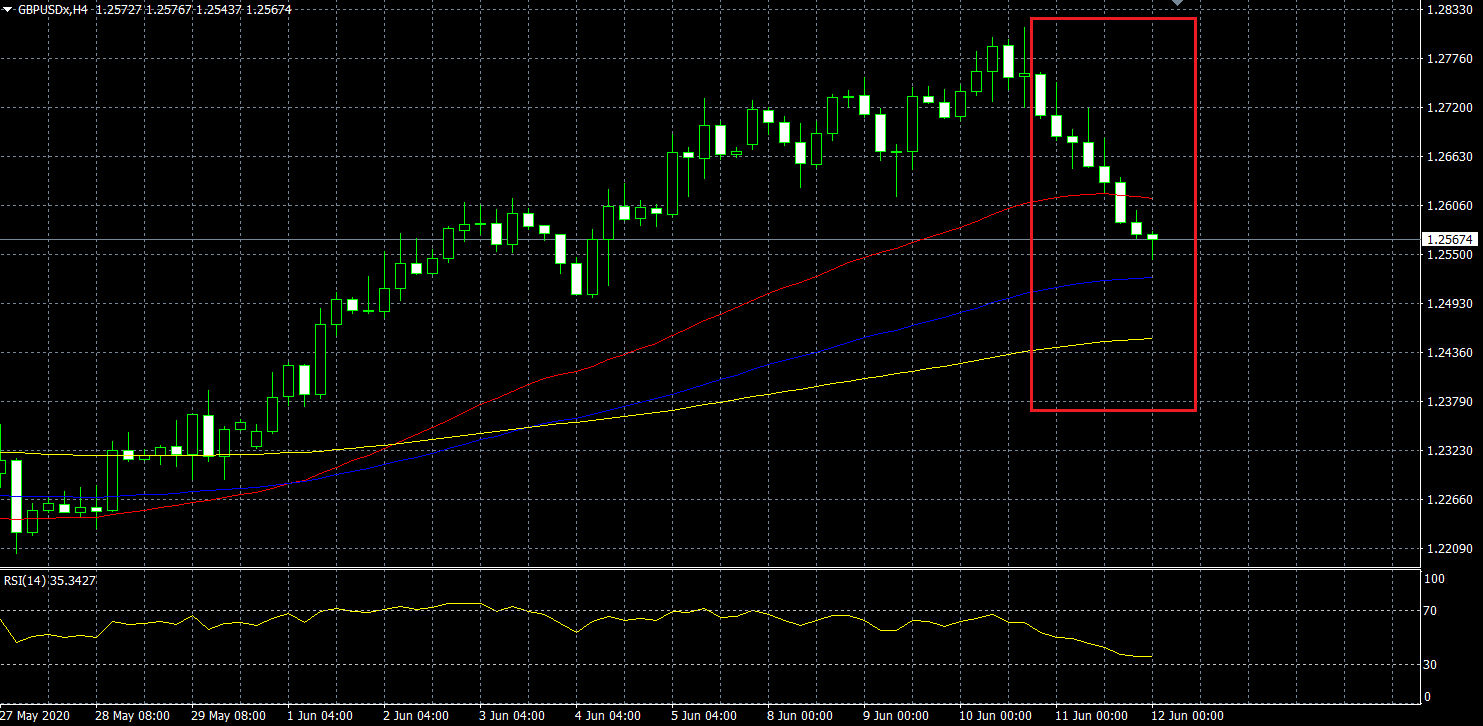

Pound surfed down the slideway after the Fed issued FOMC statement Thursday, hitting weekly low at 1.25686 as yesterday’s close. Mentioned the committee decided to maintain their main rate at quarter-point or zero, indicating no raise in the near future, undermining the dollar. Plus, the shaking data to be released later this afternoon on UK’s GDP performance forecasted to be down approximately 20%, which is critical to the cable’s fluctuation. Not to mention the escalating Brexit pressure remains mixed, leaving the market to be indifferent on bulls nor bears on this end.

H4 charts saw a consecutive downtrend on closing, backed down from trading above the 50EMA (red), testing next to hit 200EMA (yellow) depending highly on the UK GDP figure publish which acts as a critical support level below 1.25 floor. If a dipping RSI continues downward below the 30 mark, this could potentially be an opportunity for buyers at that point. In the near term, market seems to be biased to a bear trend and in the long term however, would largely depend on the concurrent negotiation between the Kingdom and the E.U in my opinion.

Daily Pivot 1.2759

S1 – 1.2706 R1 – 1.2797

S2 – 1.2668 R2 – 1.2851

S3 – 1.2577 R3 – 1.2942

Opportunity to enter short at 1.2567 with stop loss at 1.2632 and take profit at 1.2508.

Analyzed by: Mr. Ronald Wu, Independent Analyst