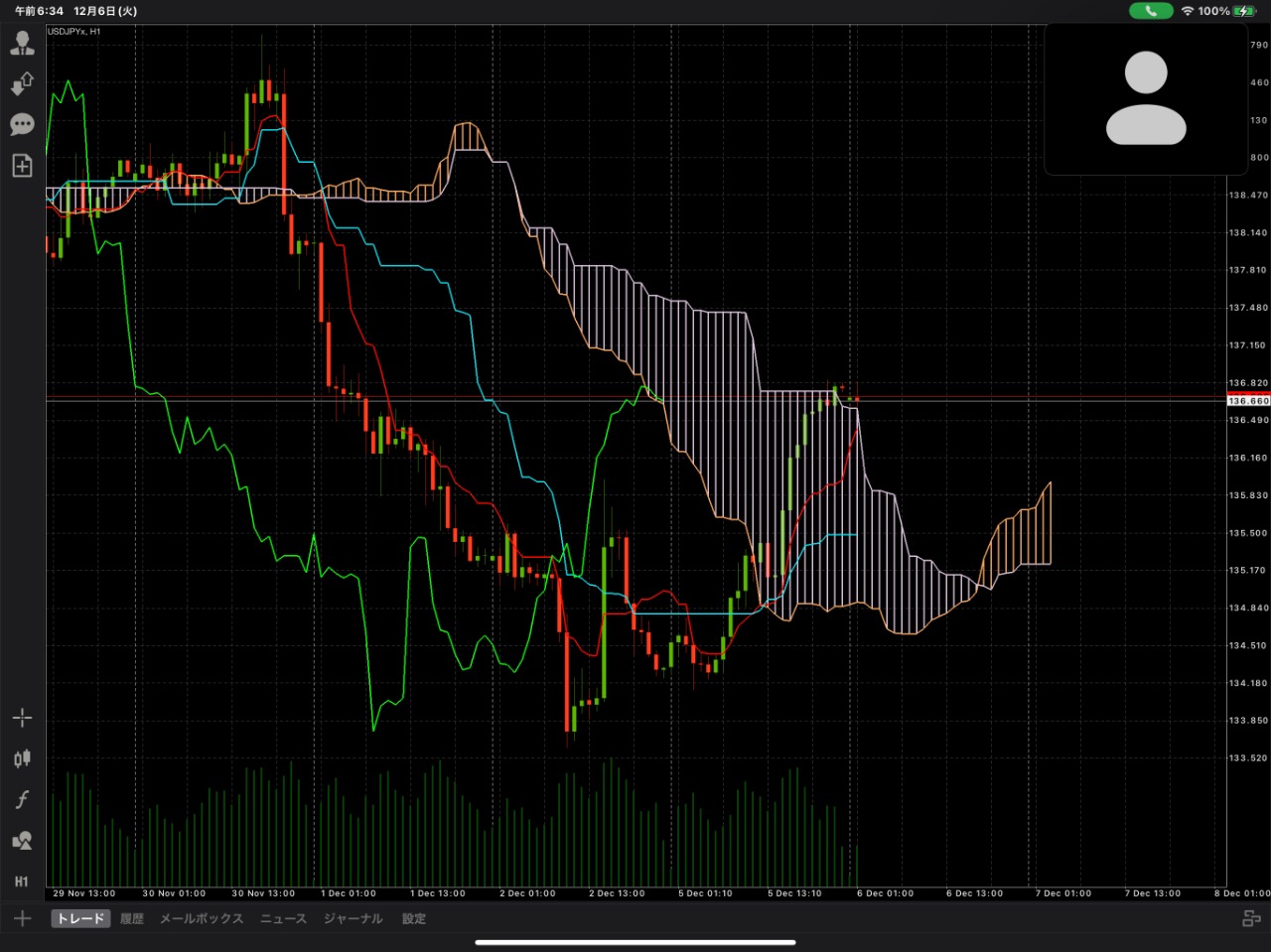

USD/JPY Technical Analysis

- 2022-12-06

The dollar-yen pair turned downward after hitting a high of 142.27 on November 21st, and fell sharply to 133.62 (the lowest level since August 16th) on Friday (December 2nd), the lowest level in about three and a half months. Yesterday, however, the buyback pressure intensified, and the price quickly returned to 136.87 toward the afternoon of US time. However, the candlestick must be moving below the main technical points (Ichimoku Kinko Hyo Conversion Line and Base Line, Ichimoku Kinko Hyo Cloud Upper and Lower Clouds, 21-day Moving Average and 90-day Moving Average). and the Ichimoku Kinko Hyo reversal of three roles suggesting a strong sell signal, technically speaking, it can be judged that there is little room for the upside.

In terms of fundamentals, there are also speculations that the nominal interest rate differential between Japan and the United States will narrow (the disparity in monetary policy between the United States, where a slowdown in interest rate hikes is expected, and Japan, where the exit from monetary easing under the post-Kuroda regime is expected), and There is an increasing number of factors suggesting a fall in the dollar-yen exchange rate, such as concerns about unwinding of yen carry trades (risk of unwinding of yen shorts by Japanese individual investors such as Mrs. Watanabe).

Based on the above, we continue to forecast the continuation of the “dollar-selling/yen-buying trend” as the main scenario (beware of the risk of a full-round pullback). However, as far as today is concerned, there have been few announcements of U.S. economic events (no notable economic events other than the U.S. trade balance in October), and the blackout period has already begun (Fed members refrain from making statements on monetary policy). Since no statements are expected from U.S. officials, we cannot expect an event-driven market formation, and the price movements are likely to be somewhat lacking in direction (however, the WSJ, the spokesperson for the Fed during the blackout period, Be careful of Nick’s remarks and tweets).

Today’s expected range: 135.75-137.25.

Analyst: Mr. Naoto Arase, Independent Analyst