Weekly Gold Price Analysis Gold odds fall but in ‘waiting’ trend

- 2020-11-24

This week, the price of gold is instable. Despite there was a good news of Covid 19 vaccine has been found from the world’s largest pharmaceutical companies, there are concerns about transportation, long-term storage, and distribution to the entire population. This is a challenge for both developed and developing countries.

Last week we observed that the odds of gold began to fall from 1896 to 1853 and also rebounded to a high of 1877. At the moment, price is instable.

The uptrend or the downtrend of gold is being challenged by big news, which has a huge impact on investors’ decisions. I would like to comment on the main information factors that can cause the price of gold to fluctuate and reach the latest trend of gold odds.

- Fundamental Analysis

1.1 Vaccines from two major pharmaceutical companies, Pfizer and BioNTech, have recently 95% of all successful trials and efficiencies and are applying for licenses to distribute the vaccine. The main challenge of this vaccine is the problem of storage and transportation to the people because the vaccine contains BNT162B2 need to store for 6 months, they need to keep the temperature of this vaccine in the temperature below zero -70 degrees Celsius, and if you need to use this vaccine within 24 hours, the temperature is at least 2 to 8 degrees Celsius.

Another US pharmaceutical company, Moderna, has announced a vaccine efficacy of 94.5% and plans to produce and distribute up to 20 million doses.

The good news is that the beacon of gold is moving in the direction of a downward trend through the optimism of the people as well as investors in preventing further COVID19 pandemic.

1.2 Stimulus Package Stimulus Package

Due to the growing rate of Covid19 infection, which is urging the US government to discuss and seek an agreement soon to approve the stimulus package to address Urgent to prevent the spread of the Covid19 crisis, as well as help restore the national economy as a whole. Injecting cash into the national economy by any means, for whatever purpose, can have a significant direct impact on the value of the national currency. The program is projected to cost up to $ 2.2 trillion, which will cause inflation to rise, the only gold that can withstand the fluctuations of inflation, commonly known as “safe haven”.

As the number of COVID19 infection cases of measles in the United States continues to rise, Republican Sen. McConnell has agreed to resume talks with Democrats on the approval of the stimulus package for immediate resolution on this COVID19 disease.

We know the announcement of the success of the search for a vaccine against this disease, but the problem is the risk of transportation, keeping the temperature up to strict standards. All in all, with or without a solution, the economic situation of countries around the world, especially the United States, before the third quarter of next year still faces many difficulties and challenges that economic recovery.

Due to the uncertainties of the recovery process, the consequences of the collapse of large enterprises and the retail sector as a whole are the main factors driving the rise in gold prices.

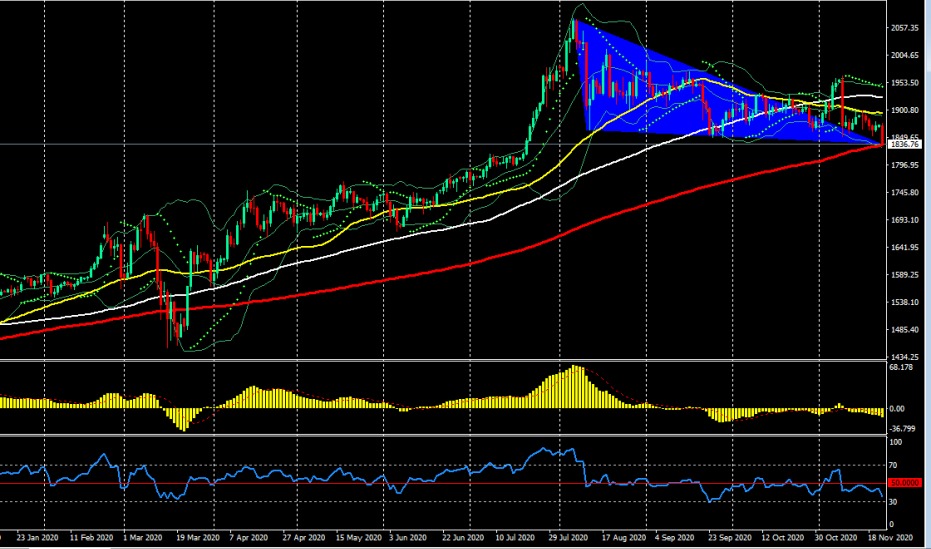

- Technical Analysis

If we look at the analysis based on the fundamentals, we see that the price of gold affected the first price support in 1840, and if the price of gold continues to fall until the break of the price of support2 1795, gold will form a downward trend BEARISH TREND.

But if the price of gold continues to run on the first support, heading down to the second support, but reversing up to the first resistance of 1910, then gold will be able to form a rapid uptrend and break the 2000 price.

Overall, although the current gold price continues to fall due to the above-mentioned factors, it is still waiting for a chance of reversal after the handover of the full presidency of the United States to Joe Biden, who Scheduled for January 20, 2021 and the new president’s immediate action through the approval of the stimulus package.

- Important data to follow this week

Tuesday 24th

2:00 pm German GDP data

10:00 pm Consumer Confidence Index Data

Wednesday 25th

8:30 pm Announcement of US GDP data and unemployment rate data

10:00 pm Announcement of new homes sale data

10:30 pm US Crude Inventory Data Release

Analyzed by: Mr. Chea Prasith,Independent Analyst